The Evolution of tBTC and the End of Over-Collateralization

Four Years of Bridging Bitcoin

Billions of dollars in BTC are currently being activated thanks to Bitcoin L2s. The Bitcoin scaling narrative is only going to grow from here as funding continues to pour in, the L2s announce their official launches, and industry OGs continue to validate the narrative.

Attempting to capture a share of this rapidly growing L2 market, various BTC bridge models are popping up. Yet, these protocols show that they are not forward-looking, using outdated overcollateralized models or making unrealistic claims of achieving trustlessness.

On the contrary, the tBTC Bitcoin bridge has been in operation for nearly 4 years. And over those years, it has undergone stress tests and important changes that set it apart from the rest of the tokenized BTC market. Built by a team at Thesis and powered by the Threshold Network, tBTC is the only long-term scalable and decentralized Bitcoin bridge in production.

The History of tBTC

Since its inception, tBTC has:

- Safely bridged over 8k BTC ($560M+ today)

- Been open-source from day one

Where tBTC truly stands out is its robust history, evolving from a simple overcollateralized bridge model into a trust-minimized solution with a distributed set of network signers. As Bitcoin L2 networks create a path for the world’s hardest currency to take a larger place in global commerce, tBTC plays a crucial step in activating idle BTC.

Why tBTC?

tBTC is open-source and has been since day one. This commitment to code transparency remains the best standard for building secure decentralized infrastructures.

Finely tuned to scale, tBTC v2 can meet to user demand, unlike overcollateralized wrapping models that are severely restricted. This nuance is critical to the future success of tBTC v2, and the ultimate differentiator between tBTC and inferior mechanisms.

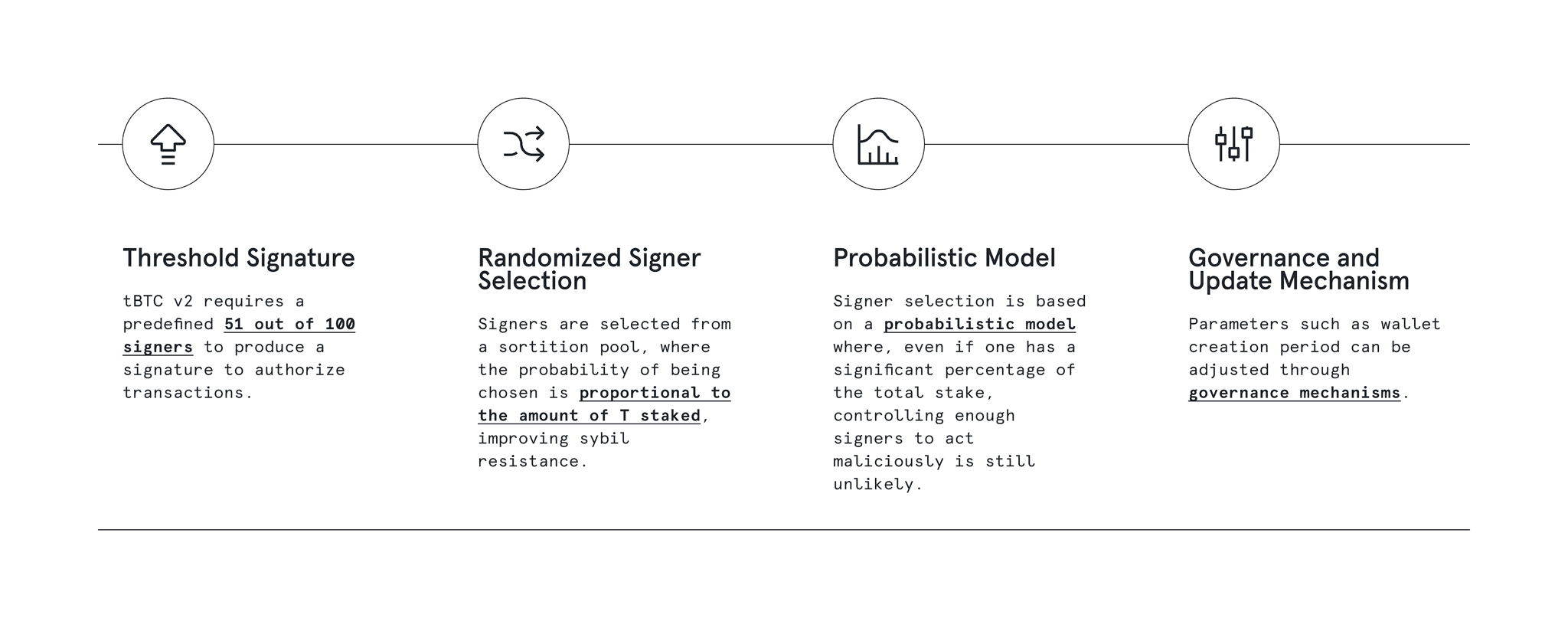

tBTC v2 can sidestep the requirement of the economic guarantees via over-collateralization by instead relying on probabilistic guarantees. When minting tBTC, 51 out of 100 signers are randomly selected to provide a decentralized custodial system for the locked BTC. This (currently allow-listed) set of signers stake T, the native Threshold Network governance token, to be selected for transaction signatures.

While every other wrapped BTC solution is a centralized or hybrid alternative, tBTC stands out as a trust-minimized bridge aligned with Bitcoin’s tenets of accessibility, security, and transparency.

From tBTC v1 to tBTC v2

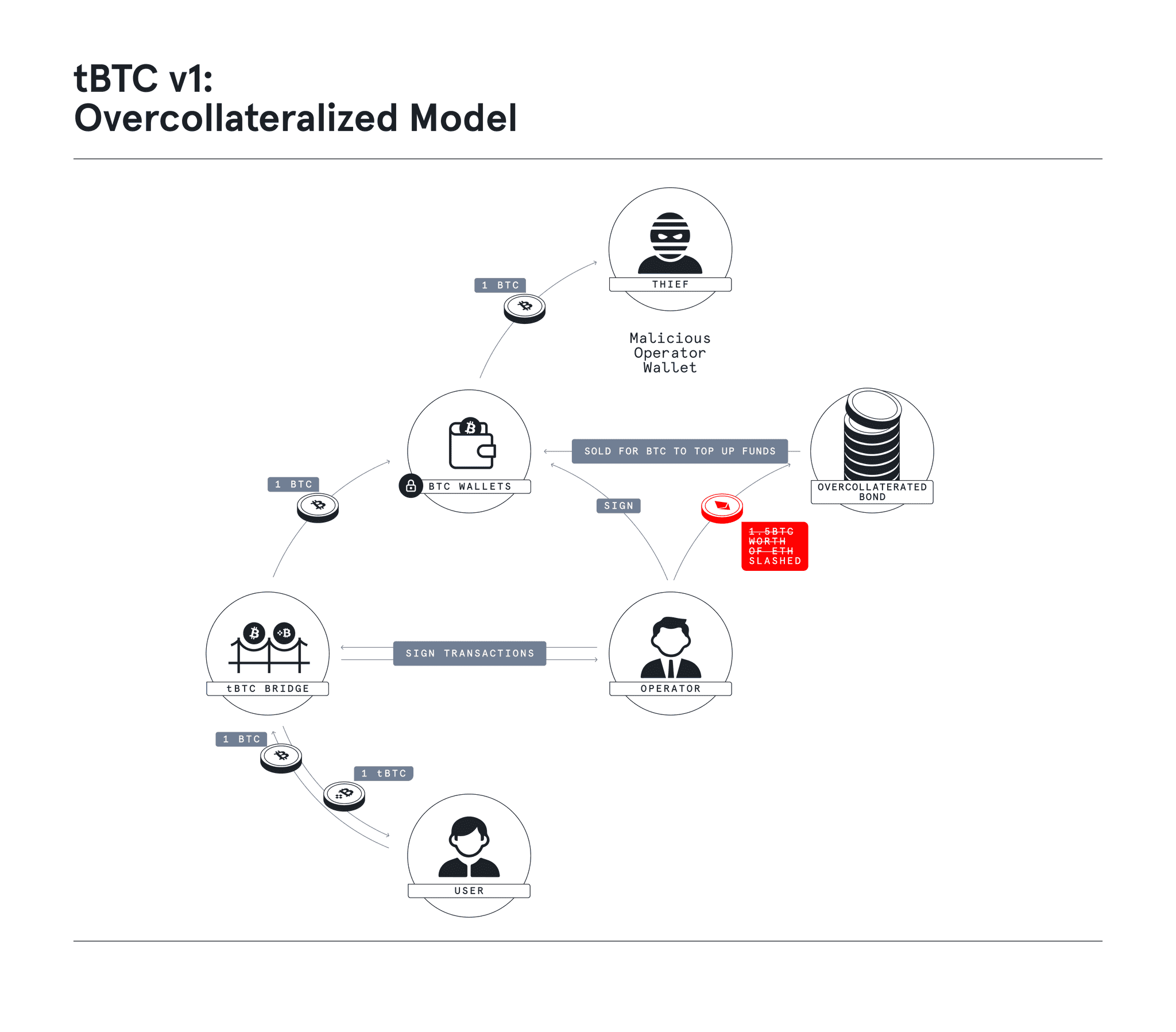

Today, tBTC is a trust-minimized bitcoin bridge, but getting there was meticulous and well-considered. Bitcoin bridge models can either use a trusted middleman, like Bitgo with wBTC, to create a 1:1 ERC-20 representation of BTC, or they can overcollateralize to provide an “economic guarantee” of security.

tBTC v1 used this economic guarantee to keep signers honest. With this model, if a malicious operator steals the funds in tBTC wallets, they’ll lose out on more money than they stand to gain. This makes it completely illogical to act against the protocol's interest.

With tBTC v1, bridging bitcoin to Ethereum occurred through “signer groups” which act as transaction processors rather than a trusted middleman, collecting a fee for each mint. These signers were Keep Operators, back when tBTC was operated solely by the Keep Network.

Although technically an effective means of bridging BTC, tBTC v1 couldn't due to the capital lock-up requirements. Capital seeks an efficient route, and locking up large sums to bridge bitcoin into other ecosystems created an obstacle to longer-term growth.

Many Bitcoin bridging models proposed in the last 6 months are designed this way, but having walked this path, tBTC has moved on to a more efficient alternative.

tBTC v2: Ending Over-Collateralization

Shortly after Keep Network and NuCypher merged to create the Threshold Network, tBTC v2 debuted a more capital-efficient model: rather than over-collateralization, security is provided by the probabilistic and statistical guarantees of a distributed and random signer selection process. Through this method, tBTC reserves remain fully backed by BTC across Threshold’s decentralized custody network. The key components of v2:

tBTC v2 went live in January 2023, allowing deposits only at launch, with redemptions enabled seven months later. It was the first scalable and permissionless BTC bridge. In comparison, the v1 rollout saw an initial supply cap slowly lifted over the initial months of launch.

With the historic learnings from tBTC v1 and the current progress of v2, Threshold is primed to continue it’s success as the most Lindy decentralized bitcoin bridge.

The Future of Bitcoin L2 Scaling

The evolution of Bitcoin’s L2 scaling will not be risk-free. Protocols that rely on rushed and under-engineered bridging models will not be able to compete with those that are time-tested and designed for long-term scaling. Whether by way of single-entity custody risk or capital restrictions that prevent scaling, other bridges show areas of weakness for the Bitcoin L2 season that everyone is looking forward to.

At the foundation of the Bitcoin L2 sector is tokenized bitcoin, where tBTC is positioned to be a significant contributor. As more networks look for ways to activate BTC capital in their ecosystem, tBTC will be an increasingly attractive option for its robust history and functionality.

A Proven Model for Bitcoin Bridging

Bitcoin bridging innovation is not an easy problem to solve. Even breakthrough applications like BitVM are showing flaws, seeming to be years away from finding a safe and secure bridging application. What we have today in tBTC is a proven model, and as Bitcoin L2s heat up, tBTC is positioned to be one of the most significant contributors to continuing the growth of this sector thanks to L2s using tBTC as their foundation.